Navigating the labyrinth of mortgage financing can feel overwhelming, especially when pondering whether to buy down your interest rate. This comprehensive guide will illuminate the intricate details surrounding how much to buy down your interest rate, helping you unravel the mystery behind discount points and their potential impact on your long-term financial well-being. We will explore the critical factors to consider, from your loan term and financial goals to the prevailing market conditions, empowering you to make a confident and informed decision. Discover when and why paying upfront to secure a lower rate could be a savvy move, and understand the mechanics of calculating your breakeven point, ensuring you invest wisely in your homeownership journey. This article is your essential resource for mastering the art of interest rate reduction and making strategic financial choices for your home.

Have you ever wondered if you should invest more upfront to save money on your mortgage over time? Many aspiring and current homeowners frequently ask, How much to buy down your interest rate, and when does it truly make sense? Understanding this powerful financial tool is essential for anyone navigating the complexities of home financing in todays dynamic market. Who benefits most from this strategy? Typically, those who plan to stay in their homes for many years. What exactly is buying down an interest rate? It involves paying an upfront fee, known as discount points, to your lender at closing in exchange for a reduced interest rate on your home loan. When is the ideal time to consider this option? Often, it is during periods of higher interest rates or when you secure a loan you intend to hold for the long haul. Where does this transaction occur? It is all part of your closing costs when you finalize your mortgage. Why would someone choose this path? The primary motivation is to significantly lower your total interest paid over the life of the loan and reduce your monthly mortgage payments. How do you go about doing it? You simply discuss the option with your mortgage lender, explore different scenarios, and factor the cost into your closing expenses. This strategic decision can profoundly impact your financial future, transforming a potentially large interest burden into tangible, long-term savings, empowering you to make a confident step towards greater financial control over your homeownership journey.

Understanding How Much to Buy Down Your Interest Rate: What Does It Mean?

When you hear people talk about how much to buy down your interest rate, they are essentially discussing the strategic use of mortgage discount points. What are these points, and how do they really work to lower your interest rate? A discount point is an upfront fee you pay to your mortgage lender in exchange for a lower interest rate on your loan. Each point typically costs 1% of your total loan amount. For example, on a $300,000 mortgage, one point would cost you $3,000. This upfront payment reduces the interest rate you pay over the life of your loan, resulting in lower monthly payments and substantial long-term savings. So, who truly benefits from this particular strategy? Homeowners who plan to live in their home for an extended period, perhaps five to ten years or even longer, often find this approach extremely beneficial. Why? Because the longer you hold the mortgage, the more time you have for the monthly savings from the lower interest rate to recoup the initial cost of the points, eventually leading to pure savings. This method empowers you to take control of your mortgage costs from the outset, actively shaping your financial commitment rather than passively accepting the initial rate offered.

The Cost of Buying Down Your Interest Rate: How Much Do You Pay?

Understanding the actual cost when you ask how much to buy down your interest rate is straightforward yet crucial for smart financial planning. Typically, one mortgage discount point equals 1% of your total loan amount. So, if you are securing a $400,000 mortgage and decide to purchase one point, that will cost you $4,000. But what does that $4,000 get you? Generally, one point might reduce your interest rate by approximately 0.25%, though this can vary slightly depending on your lender and market conditions. You pay these costs upfront, usually at your loan closing. It is a part of your overall closing costs, which include other fees like origination fees, appraisal fees, and title insurance. Why is this important to know? Because these upfront expenses require available cash. You need to assess if you have sufficient funds without depleting your emergency savings. When you factor in the cost of buying down, you are making a direct investment in your future mortgage payments, aiming to significantly reduce your financial outflow each month. This strategic payment empowers you to gain immediate control over your long-term borrowing expenses, providing a sense of calm confidence in your financial decisions.

Why Consider Buying Down Your Interest Rate: Unlocking Long-Term Savings

Why would anyone consider spending extra money upfront when contemplating how much to buy down your interest rate? The answer lies in the compelling potential for significant long-term financial benefits. Imagine reducing your mortgage interest rate even by a small fraction; over the course of a 15-year or 30-year loan, those small monthly savings add up to thousands, even tens of thousands, of dollars. This strategy becomes particularly attractive during periods of higher interest rates, as a greater reduction translates into more substantial savings. The key concept here is the breakeven point – the moment your accumulated monthly savings from the lower interest rate surpass the initial cost you paid for the points. Why is reaching this point so critical? Because after you cross it, every subsequent mortgage payment represents pure, tangible savings in your pocket. This makes buying down your rate a smart move for borrowers who are committed to their homes for the long haul. It is an active decision to invest in your future financial stability, empowering you to reduce the overall cost of homeownership and free up funds for other life goals.

Calculating Your Breakeven Point: When Does Buying Down Make Sense?

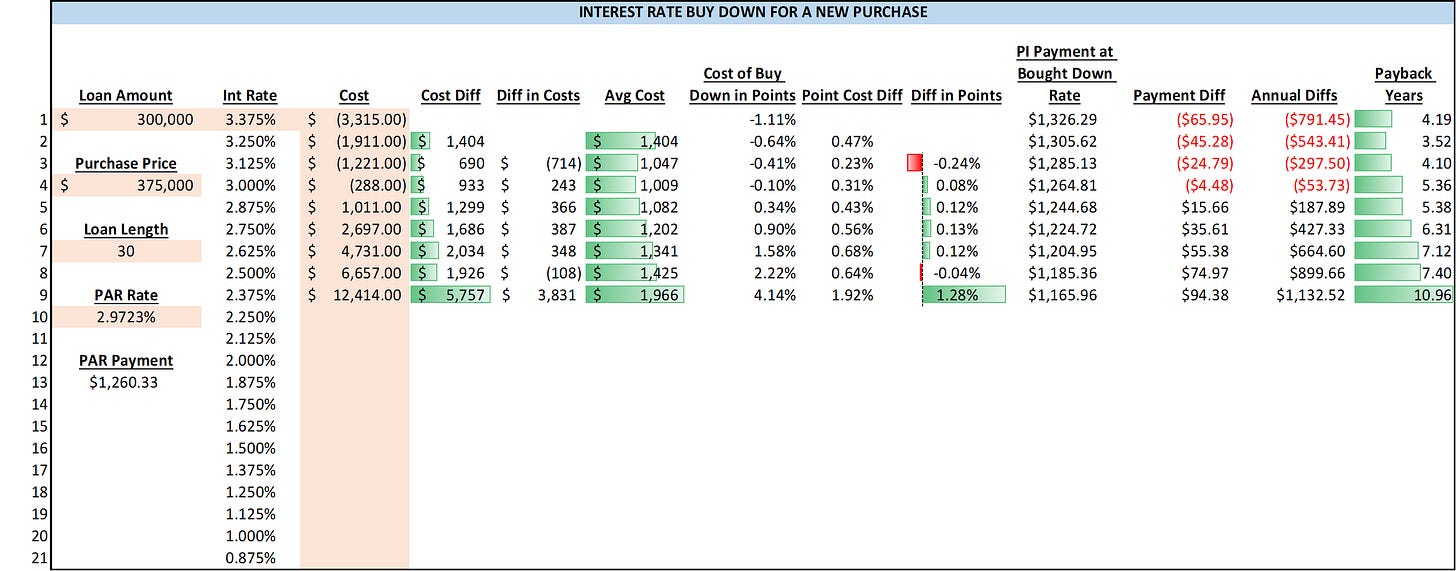

So, you are asking how much to buy down your interest rate and want to know when it makes financial sense? Calculating your breakeven point is your navigational star. This calculation helps you determine exactly when your monthly savings from a lower interest rate will cover the initial cost of purchasing discount points. Here is a simple way to approach it: divide the total cost of the points you paid by the amount you save on your mortgage payment each month. The result tells you how many months it will take to recoup your upfront investment. For example, if you pay $3,000 for points and save $50 per month on your mortgage payment, your breakeven point is 60 months, or five years. What factors influence this critical calculation? Your loan term (a 30-year loan often benefits more than a 15-year loan due to more interest paid over time), the exact reduction in your interest rate, and the precise cost of the points all play a vital role. When is the best time to run these numbers? Always before you commit to your loan, as it allows you to compare different scenarios and confidently decide whether buying down aligns with your financial timeline and homeownership plans. This proactive analysis empowers you to make a truly informed and intelligent choice.

Factors Influencing How Much to Buy Down Your Interest Rate: Personalizing Your Strategy

Deciding how much to buy down your interest rate is not a one-size-fits-all situation; it is a highly personal financial choice influenced by several key factors. Understanding these elements empowers you to tailor a strategy that best suits your unique circumstances. Consider your loan term: will you have a 30-year or a 15-year mortgage? A longer loan term generally means more interest paid over time, making the savings from a lower rate even more substantial and potentially justifying a higher upfront investment in points. What are your specific financial goals? Are you planning to live in this home for many years, or do you anticipate moving in just a few? If your long-term plan is homeownership, then buying down your rate offers greater cumulative savings. On the other hand, if you expect to move within a few years, the breakeven point might extend beyond your intended stay, making points less attractive. Furthermore, assess the current interest rate environment: when rates are generally high, a buy-down offers a more significant opportunity for savings, making the investment more impactful. Finally, critically evaluate your available cash reserves: can you comfortably afford the upfront cost of points without straining your finances or depleting your emergency fund? Thinking through these elements helps you make a strategic, confident decision.

Your Loan Term: How Much to Buy Down Your Interest Rate and the Length of Your Mortgage

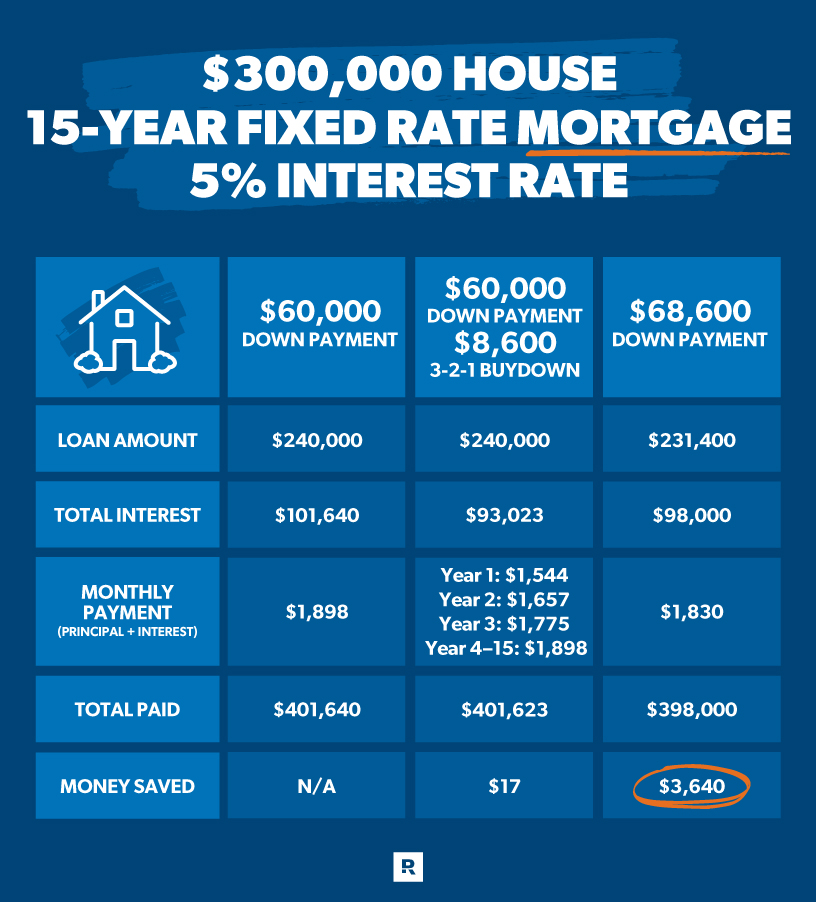

When you are thinking about how much to buy down your interest rate, the length of your mortgage term plays a much larger role than many people realize. Why does it matter so much if you choose a 30-year versus a 15-year loan? Simply put, a longer loan term means you pay interest for a much longer period. On a 30-year mortgage, even a small reduction in your interest rate, achieved by buying down, can translate into substantial savings over those three decades. The cumulative effect of lower monthly payments, month after month, truly adds up. With a 15-year loan, you pay off your mortgage faster, so while the per-month savings are still welcome, the total interest paid is already much lower than a 30-year loan. Therefore, the financial impact of buying down points might be proportionally less significant in total dollar savings for a shorter loan, though the breakeven point could be reached faster due to higher monthly payments in general. You need to ask yourself: how long do I plan to keep this mortgage? The answer will heavily influence whether an upfront investment in points offers you the best return for your specific situation. This insight empowers you to align your buy-down strategy with your long-term financial commitment.

Your Financial Goals: How Much to Buy Down Your Interest Rate and Your Future Plans

Your personal financial goals are pivotal when you determine how much to buy down your interest rate. Are you aiming for long-term homeownership, perhaps seeing this house as your forever home or at least a significant chapter in your life? If so, investing in discount points can be a very wise move. The longer you remain in your home and hold that mortgage, the more opportunity you have to pass your breakeven point and truly capitalize on the monthly savings generated by a lower interest rate. Conversely, if your plans involve selling or refinancing within a few years, perhaps due to a job relocation or a desire for a larger home, then paying for points might not be the most advantageous strategy. Why? Because you might not stay in the home long enough for the accumulated monthly savings to offset the initial upfront cost of the points. Understanding your timeline is key. Do you foresee significant life changes on the horizon, or are you settling in for the long haul? This critical self-reflection empowers you to make a decision about buying down your rate that perfectly aligns with your personal roadmap, ensuring your financial actions support your future aspirations.

Current Interest Rate Environment: How Much to Buy Down Your Interest Rate and Market Trends

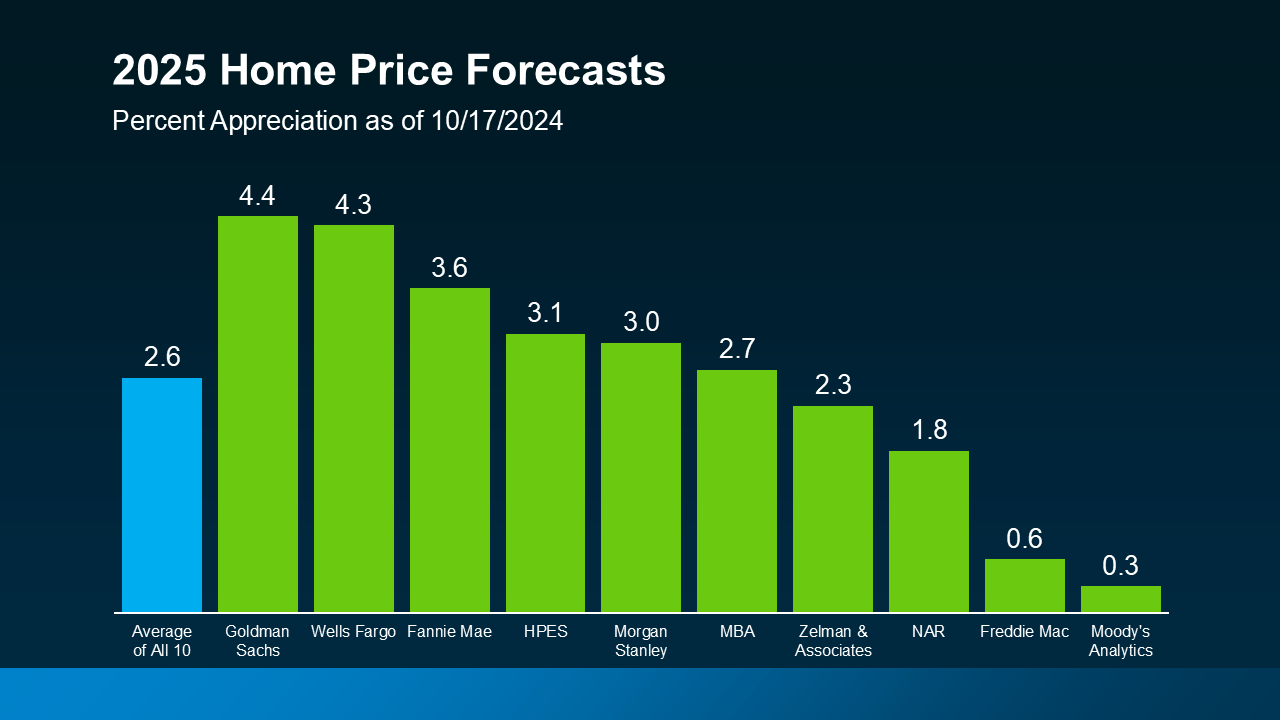

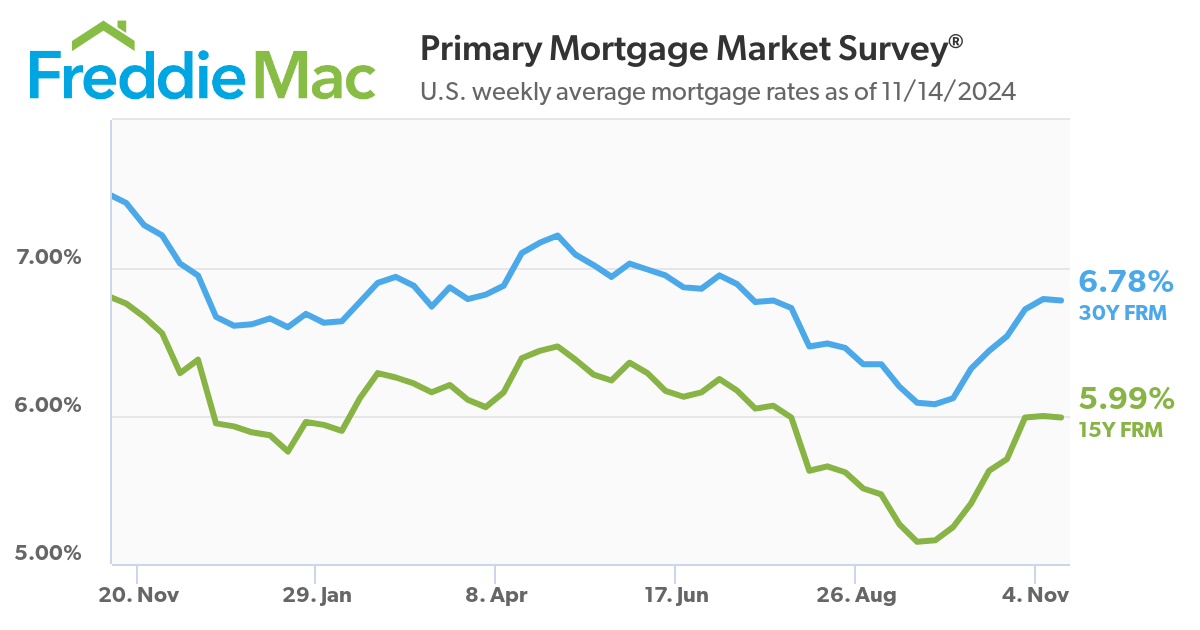

The prevailing interest rate environment significantly shapes your decision on how much to buy down your interest rate. Whats the market saying right now? In times when mortgage rates are generally higher across the board, the value proposition of buying down your rate becomes even more compelling. Why? Because a greater reduction from a higher starting point results in more substantial monthly savings, which accelerates your breakeven point and amplifies your long-term benefits. Conversely, if rates are already historically low, there might be less room for a significant rate reduction through points, making the investment less impactful or harder to justify. You should always monitor economic forecasts and discuss current market trends with your mortgage professional. When you understand the broader financial landscape, you can make an informed decision about whether paying for points offers a truly strategic advantage. This proactive approach ensures you are not just reacting to an offer, but actively leveraging market conditions to your financial benefit, confidently securing a more favorable mortgage.

Available Cash: How Much to Buy Down Your Interest Rate and Your Liquidity

A crucial consideration when asking how much to buy down your interest rate is your available cash. Can you genuinely afford the upfront cost of these discount points without placing yourself in a precarious financial position? Remember, paying for points requires a lump sum payment at closing, which adds to your existing closing costs. Why is this so important? Because depleting your emergency savings or stretching yourself too thin can create unnecessary stress and risk. You need to ensure you maintain adequate liquidity for unexpected expenses, home repairs, or other financial priorities after you complete your home purchase. Where will this money come from? Typically, it comes from your savings or other liquid assets. Carefully assess your budget and financial reserves. If you have surplus cash that is not allocated for other immediate needs or higher-return investments, then using it to buy down your rate might be a smart move. However, if your cash reserves are already tight, prioritizing an emergency fund over points is usually the wiser decision. This thoughtful assessment of your financial readiness empowers you to make a responsible and confident choice about managing your capital effectively.

Alternative Investments: How Much to Buy Down Your Interest Rate and Opportunity Cost

When you contemplate how much to buy down your interest rate, you are also implicitly considering the concept of opportunity cost. What does that mean? It refers to the value of the next best alternative you give up when you make a choice. If you use a certain amount of cash to buy down your interest rate, you are choosing not to invest that same amount of money elsewhere. Could that cash potentially generate a higher return in a different investment vehicle, such as the stock market, a high-yield savings account, or perhaps paying down other higher-interest debt, like credit cards or student loans? Why is this comparison important? Because you want your money to work as hard as possible for you. If an alternative investment offers a demonstrably higher, relatively safe return than the savings you would generate by buying down your rate, then that alternative might be the smarter financial move. This careful evaluation ensures you allocate your capital most effectively, optimizing your financial growth and truly making your money count. It is about empowering yourself with a holistic financial perspective.

| Scenario | Loan Amount | Initial Rate | Points Paid | New Rate | Upfront Cost | Monthly Savings (Approx.) | Breakeven Point (Months) |

|---|---|---|---|---|---|---|---|

| No Buy-Down | $300,000 | 7.00% | 0 | 7.00% | $0 | $0 | N/A |

| 1 Point Buy-Down | $300,000 | 7.00% | 1 | 6.75% | $3,000 | $49 | 61 |

| 2 Point Buy-Down | $300,000 | 7.00% | 2 | 6.50% | $6,000 | $97 | 62 |

| No Buy-Down | $500,000 | 6.80% | 0 | 6.80% | $0 | $0 | N/A |

| 1 Point Buy-Down | $500,000 | 6.80% | 1 | 6.55% | $5,000 | $84 | 60 |

| 2 Point Buy-Down | $500,000 | 6.80% | 2 | 6.30% | $10,000 | $167 | 60 |

The Process: How Do You Buy Down Your Interest Rate?

Once you decide that how much to buy down your interest rate is a question you want to pursue, understanding the practical steps involved is crucial. The process itself is surprisingly straightforward. First, you need to engage in an open and detailed discussion with your mortgage lender. Who do you talk to? Your loan officer is your primary point of contact, as they possess the expertise to walk you through all the available options. When should you have this conversation? Ideally, during the initial stages of your loan application, well before you finalize your mortgage. This gives you ample time to compare different scenarios and understand the exact costs and benefits. Your lender will provide you with a Loan Estimate, a vital document outlining your interest rate, fees, and closing costs, including any charges for discount points. You can ask for different versions of the Loan Estimate showing various numbers of points purchased and their corresponding interest rate reductions. Where does this all happen? It is an integral part of your overall mortgage application and approval process. Why is this collaboration so important? It ensures transparency and allows you to make an informed decision tailored to your financial situation. How do you officially commit? You simply indicate your preference for buying down the rate, and those costs become part of your closing disclosure, paid at the loan closing. This clear communication empowers you to confidently navigate your mortgage journey.

Navigating the Decision: Is Buying Down Your Interest Rate Right for You?

So, after exploring all the angles, you might still be pondering, Is buying down my interest rate truly the right decision for me? The power to make this choice rests entirely in your hands, informed by a solid understanding of your personal financial landscape and long-term goals. Remember, this is not just about a lower number; it is about strategic financial empowerment. Consider your commitment to your home: if you envision residing there for many years, the long-term savings from a reduced interest rate can profoundly benefit your financial future. Reflect on your cash reserves: can you comfortably afford the upfront cost without compromising your financial security? Also, weigh the current interest rate environment and your alternative investment opportunities. Consulting with a trusted financial advisor can provide an additional layer of clarity and confidence, offering an objective perspective tailored to your unique situation. Ultimately, making an informed decision about how much to buy down your interest rate allows you to take proactive control of one of your most significant financial commitments, ensuring your mortgage aligns perfectly with your aspirations and securing a more stable and prosperous future for your homeownership journey.

Summary Question and Answer:

Q: What are mortgage discount points?

A: Mortgage discount points are an upfront fee paid to your lender at closing to secure a lower interest rate on your loan, typically costing 1% of the loan amount per point.

Q: When does buying down your interest rate make sense?

A: It generally makes financial sense when you plan to stay in your home for an extended period, allowing the monthly savings from the lower interest rate to exceed the initial cost of the points.

Q: How do I calculate my breakeven point?

A: Divide the total cost of the discount points by the amount you save on your monthly mortgage payment; the result is the number of months it takes to recoup your upfront investment.

Q: What factors should I consider before deciding how much to buy down my interest rate?

A: Consider your loan term, financial goals, current interest rate environment, available cash reserves, and potential alternative investments for your funds.

Q: Who can help me decide if buying down my rate is a good idea?

A: Your mortgage lender can provide scenarios and calculations, and a financial advisor can offer personalized guidance based on your overall financial picture.

Keywords: how much to buy down interest rate, mortgage points, discount points, interest rate reduction, home financing, closing costs, breakeven analysis, long-term savings, mortgage strategy, financial planning

Related qa- Assurance Homecare Services Inc: What Do They Offer?

- Can You Access iCloud from Android Devices in 2026?

- PPT Resume Examples The New Job Search Edge?

- Cyber Resilience Act PDF What Does It Mean For You

Understanding discount points is crucial when considering how much to buy down your interest rate. They represent an upfront fee paid to your lender at closing in exchange for a lower interest rate on your mortgage, potentially saving you a substantial amount over the loans lifetime. Factors like your intended homeownership duration, current market interest rates, and your available cash reserves significantly influence whether this strategy is financially beneficial. Calculating your breakeven point – the moment your monthly savings surpass the initial cost of buying down – helps you determine the true value of this investment. While reducing your interest rate can lead to significant long-term savings and lower monthly payments, it is essential to weigh the upfront cost against your financial circumstances and future plans.

What Is A Buydown Mortgage Maronda Homes 3 2 1 RealEstate News Fannie Mae Forecasts Mortgage Rates For 2025 2026 Fannie Mae Latest Mortgage Rate Predictions For 2025 And 2026 Buying Down Your Interest Rate Temporary Vs Permanent With Dave Bryce Interest Rate Buydown Chart

When It Might Make Sense To Buy Down Your Interest Rate Zillow Buy Down Interest RateBuying Down Your Interest Rate Determine If It S Worth The Cost Buy Down What To Expect From Mortgage Rates And Home Prices In 2025 The BST 20241021 2025 Home Price Forecasts Original How Much To Buy Down Interest Rate Key Insights How Much To Buy Down Interest Rate

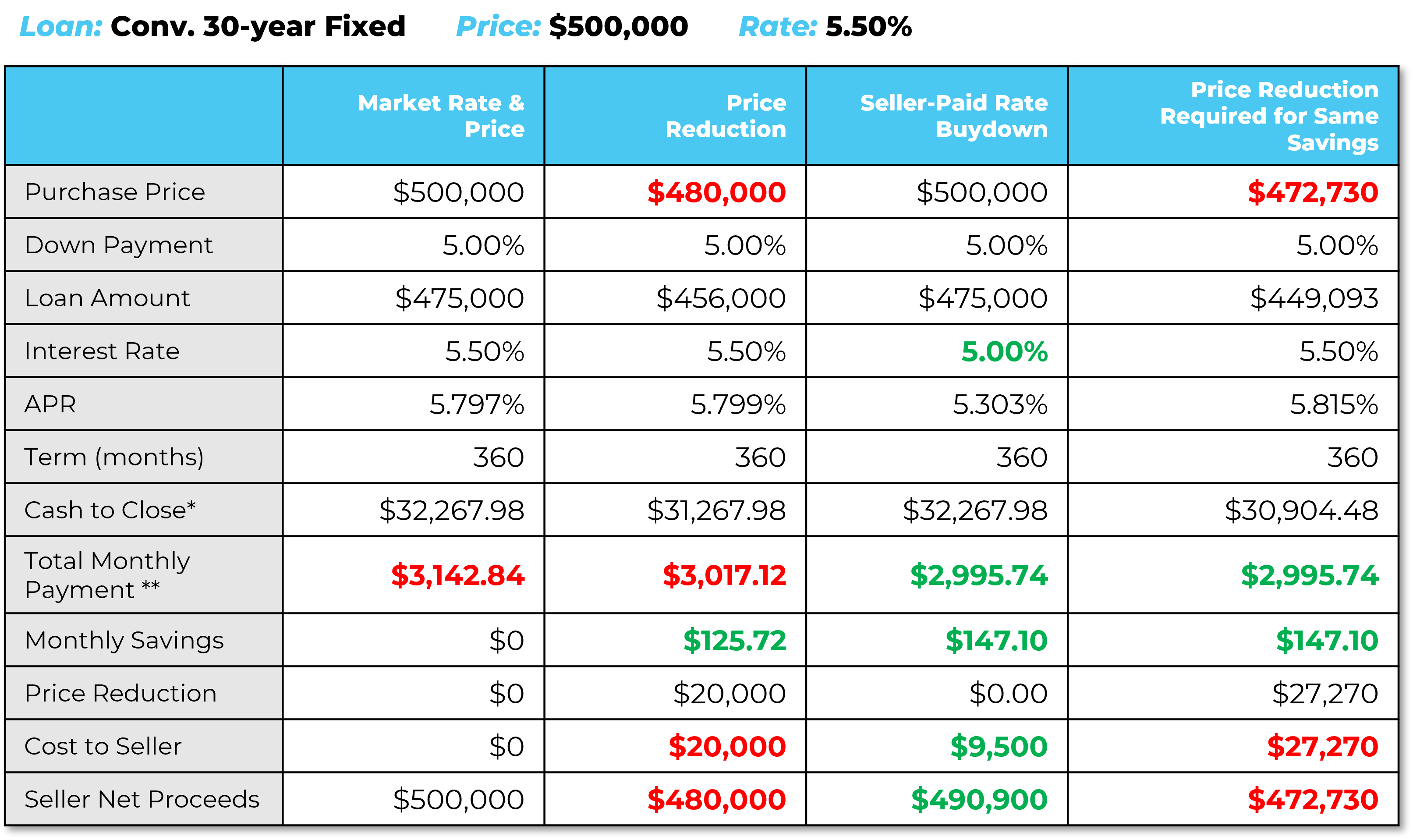

Lower Mortgage Rates Boost Your Buying Power Keeping Current Matters Lower Mortgage Rates Boost Your Buying Power NM Mortgage Rates Predictions For 2026 2025 USDA Interest Rates 2048x1229 Permanent Rate Buy Down Now Available Wayne Homes Blog Permenant Rate Buydown Infographic 2 Seller Buydowns Your Secret Weapon Against High Mortgage Rates Rate Buydown Vs Price Reduction 7

2 1 Rate Buydown Explained Price Mortgage Rate Buydown 768x768 How Much To Buy Down Interest Rate Key Insights Buy Down Interest Rate 2 1 Buydown Now Available For Michigan Loans Treadstone 2 1Buydown 2023 Buying Down Mortgage Rates Wealth Management

Will Interest Rates Go Down In 2025 And 2026 Mortgage Rate Forecast Mortgage Rate Forecast Chart For 2025 And 2026 Mortgage Rate Buydown Intercap Lending Temp Buydown Comparison Snip 01 1030x711 1.webpMortgage Rate Predictions 2026 What Experts Say About The Future Mortgage Rate Predictions For 2026 1080x565 Mortgage Rate Forecast Canada 2025 2026 Rates Dropping Mortgage Canada Bond Yield 1 Month

Will Mortgage Rates Go Down To 3 In 2026 Will Mortgage Rates Go Down To 3 Percent In 2026 What To Expect From Mortgage Rates And Home Prices In 2025 ERA 20241021 Mortgage Rates And Projections Original Interest Rates Could Remain At 4 Until 2026 Economists Say Greenock ThumbnailPermanent Rate Buydown Offer Custom Home Financing Help Permanent Buydown Infographic 12 17 24 1024x696

Mortgage Interest Rates Forecast How Low Will They Go In 2024 2025 How Much To Buy Down Interest Rate Key Insights How Much Does It Cost To Buy Down Interest Rate How Much To Buy Down Interest Rate Key Insights Buying Down Interest Rate How Much To Buy Down Interest Rate Key Insights

What Is A 3 2 1 Buydown Mortgage Ramsey 3 2 1 Buydown Graphic Mortgage Rates Predictions For Next 2 Years 2025 2026 Mortgage Rate Trends Mortgage Rate Buydown Intercap Lending Buy Down Example Flyer 1500x1028 Buying Down Interest Rates By James Orr 817c7c33 Bed4 41de 88b2 2653x1040

Will Mortgage Rates Go Down In 2026 Predictions Say Yes Will Mortgage Rates Go Down In 2026 1024x536 How A Interest Rate Buy Down Works Real Estate Mortgage 32050 How An Interest Rate Buy Down Works Mortgage Rates Forecast For Next 6 Months October 2025 To March 2026 Mortgage Rates Predictions For The Next 6 Months